Insurance

Eligibility & Enrollment

Additional Benefits

Helpful Information

Medical Coverage

Choosing a Medical Plan

During the first 31 days of eligibility and during the annual open enrollment, employees may choose among the following medical plans.

Medical providers

Kaiser Permanente WA

Visit one of Kaiser Permanente WA's online provider directories.

Kaiser Foundation Health Plan of Washington Contact Information

Online: Kaiser Permanente WA for PEBB

Phone: 1-866-648-1928

Uniform Medical Plan (UMP)

Find UMP Classic, UMP Select and UMP CDHP preferred providers:

- Medical services: Find preferred providers

- Prescription drugs: Find a network pharmacy

Find UMP Plus preferred providers:

UMP Classic/Select/CDHP Phone: 1-888-849-3681

UMP Plus Phone: 1-855-520-9500

UMP Vision Benefits are administered by VSP (Vision Service Plan)

- VSP

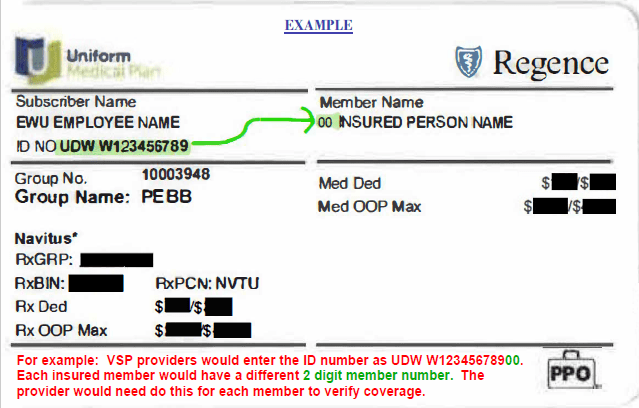

- When your provider is searching for your coverage, please make sure to have them add the 2-digit member number to your ID number. (See example below). Each insured member will have a different 2-digit number on their ID card.

Dental Coverage

Choosing a Dental Plan

During the first 31 days of eligibility and during the annual open enrollment, employees may choose among two managed care dental plans and one fee-for-service plan, the Uniform Dental Plan. There is no cost to employees for the dental coverage. EWU pays the premium on your behalf.

Dental plans

- DeltaCare and Willamette Dental Group are managed-care plans.

You must choose a primary dental provider within their networks.

- Uniform Dental (UDP) is a preferred provider plan.

You may choose any provider, but will generally have a lower out-of-pocket costs if you see network providers

Visit the plan sites for more information: DeltaCare, Willamette Dental Group, or Uniform Dental Plan.

Life Insurance Coverage

EWU provides basic life insurance to all employees eligible for full benefits. During the first 31 days of eligibility employees can enroll in optional and AD&D life insurance.

Online: MetLife MyBenefits

Access MyBenefits box: WA State Health Care Authority PEBB

Phone: 1-866-548-7139, benefits specialists available Monday through Friday, 5 a.m. to 8 p.m EST.

MetLife Enrollment/Change Form

Basic Life Insurance (Employer Paid)

EWU provides basic life insurance through MetLife at no cost to the employee. It provides:

- $35,000 for death from any cause.

- An additional $5,000 in case of accidental death or dismemberment.

As an employee, your basic life insurance covers you and pays your designated beneficiaries in the event of your death. Your basic life insurance includes accidental death and dismemberment (AD&D) insurance, which provides extra benefits for certain injuries or death resulting from a covered accident.

Long-Term Disability Coverage

Information about LTD is available:

- In the Long Term Disability Booklet

- On the HCA’s website’s Long-Term Disability insurance page

- LTD insurance premium rates on the HCA’s website

- Decision Support Tool on The Standard’s website

EWU provides basic long-term disability (LTD) insurance to employees eligible for full benefits. All benefit eligible employees will be auto enrolled in the Employee Paid LTD benefit with a 90 day waiting period at a 60% monthly benefit. Employee's have the option to change their benefit to a 50% monthly benefit or opt out of the benefit all together.

Standard Insurance Co

Customer Service: 1.800.368.2860

Long-Term Disability Enrollment/Change Form

Long-term disability (LTD) insurance is designed to help protect you from the financial risk of lost earnings due to serious injury or illness. When you enroll in LTD coverage, it pays a percentage of your monthly earnings to you if you become disabled.

What is considered a disability?

Being unable to perform with reasonable continuity the duties of your Own Occupation as a result of sickness, injury, or pregnancy during the benefit waiting period and the first 24 months for which LTD benefits are payable.

Self-Pay Benefits While On Leave

As an employee on Leave without Pay, you are entitled to PEBB continuation coverage (LWOP coverage). Employees may continue medical and dental benefits, life insurance, and in some cases, long-term disability insurance. You must enroll in continuation coverage to enroll your eligible dependents.

You are eligible to self-pay your medical, dental & life insurance, and in some cases long term disability (LTD) if you are on approved leave from an otherwise eligible position.

COBRA and Continuation Coverage

Enrollment and benefit information specific to COBRA coverage for subscribers and their dependents is available here.

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that gives you and your covered dependents the right to continue group health coverage on a self-paid basis if eligibility for the employer-sponsored group medical and dental is lost.

Affordable Care Act

Visit HealthCare.gov for additional information.

With coverage being available under the Affordable Care Act (ACA), beginning January 2014, most individuals will be required to have health insurance coverage.

Benefits offered to benefit-eligible Eastern Washington University (EWU) faculty and staff, have been determined to meet and/or exceed the standard identified by the ACA including premium affordability and acceptable health coverage levels of coverage. The regular student plan may also be a viable option.

However, employees and students currently not eligible for or covered by benefits through EWU may need/want to review the coverage options available through the Marketplace, a new way to buy health insurance under the ACA. This webpage provides basic information about the Marketplace as well as benefits offered through EWU, and its intended to assist in evaluating options for you and your family.